Biden Administration forgives student loans

September 28, 2022

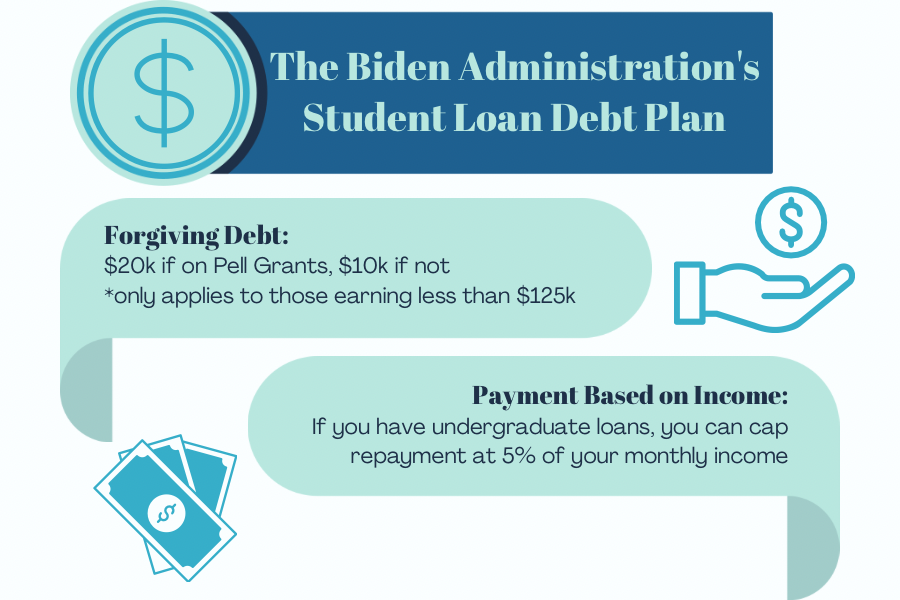

The Biden Administration announced a loan forgiveness plan where borrowers can qualify for up to $10,000 in student loan forgiveness. Currently, the United States has $1.6 trillion in cumulative federal student loan debt and 45 million borrowers. Along with this, they’re canceling $20,000 in debt for some Pell Grant recipients, extending the pause on federal loan payments and refunding any loan payments made since the beginning of the pause. The plan aims to provide relief to low- and middle-income borrowers and advance racial equity by narrowing the racial wealth gap. This plan was finalized through executive action and is expected to have pushback.

This three-step plan has been long awaited by many since President Biden paused loan repayments. To receive this assistance, the annual income must be $125,000 or lower for individual people. For those in marriage, the income must be $250,000 or lower.

“The student loan plan won’t be able to relieve my debt completely but I think it will help me not have to worry as much about saving up and paying off as much money in the future,” said Savannah Schofield, a sophomore English major. “There hasn’t been another loan forgiveness program to compare to this one so I’m not sure if the amount is fair. I would love for people to be able to receive more money since many people have loans that exceed $20,000.”

The second part of the plan is to ensure the loan system is more manageable for future and current borrowers. This step includes cutting monthly payments on loans and changing the requirements for the Public Service Loan Forgiveness program.

They want people who have worked in the military, nonprofits or any form of government to get credit on their loans through this program now. The third part of the plan is to find a way to lower the cost of college after it has risen three times the amount it was in 1988 for public schools.

“Loans are one form of assistance that helps many people access a college education that they could not afford otherwise. But student loan debt can be an impediment to some borrowers, so efforts to reduce any undue burden are important,” said Daniel McDonald, Interim Director of Public Affairs at GC.

“ Georgia College & State University’s Financial Aid Office works diligently to ensure every student can exhaust all options for helping make a college education more affordable.” said McDonald. “ At this time, we await additional guidance from the federal government on how to help make sure this loan forgiveness program achieves the maximum possible impact for student loan recipients in the Georgia College community.”

Even though governors of some states have an issue with this plan, President Biden is pushing forward. Governors Abbot, DeSantis and Ivey have signed a letter to President Biden stating their disagreement due to the taxpayers having to pay $600 billion in total to cover this plan, despite the Biden administration stating it will cost $24 billion annually.

“If they gave everybody with these outstanding debts $10,000 that would be called expansionary. So, they’re putting money in the hands of people basically if you think of it that way,” said Christopher Clark, professor of economics. “If they did give everybody the $20,000 instead that would be even more expansionary but you have to remember that money comes from somewhere. So that money is going to be pulled from currently existing tax revenue or they may have to raise taxes to fund those because it doesn’t just go away.”

GC students have been thinking about affordability when it comes to college and coming up with plans to pay for college using student loans.

“I don’t think it would help a lot considering most people have to get student loans per semester and that adds up considering interest,” said Kennedy Cook, a sophomore mass communications major. “I don’t think that would be enough. I think obviously it would help but it doesn’t make that big of a difference.”

President Biden’s plan is expected to help many with the $10,000 and $20,000 going to those who receive Pell grant.