On May 5, the Department of Education resumed collections on defaulted student loans, ending a five-year pause that began at the onset of the COVID-19 pandemic.

Since March 2020, payments and interest on most federal student loans have been paused, providing a break to millions of borrowers.

“The Biden administration extended this pause as the U.S. continued to recover from the pandemic and established new repayment programs to help student borrowers,” said the Economy Policy Institute.

This expired on January 1, 2025, so the Trump administration has now directed the Departments of Education and Treasury to resume collections from borrowers.

Following that, on July 4, the One Big Beautiful Bill Act was signed into law, resulting in more changes to some federal student aid programs.

The Biden Harris Administration Saving on Valuable Education (SAVE) plan is ending. The plan was an income-driven repayment plan for federal student loans that aimed to provide lower monthly payments and faster loan forgiveness.

Republican lawmakers argued that the plan was too generous and fell on tax payers too much.

“Yeah I think that plan just affected the taxes a lot, there are better ways to make college more affordable,” said Graham Simmons, a junior finance major.

This change does not currently affect borrowers already in the SAVE plan, but they have until 2028 to change plans. The plan is no longer available to any potential newcomers.

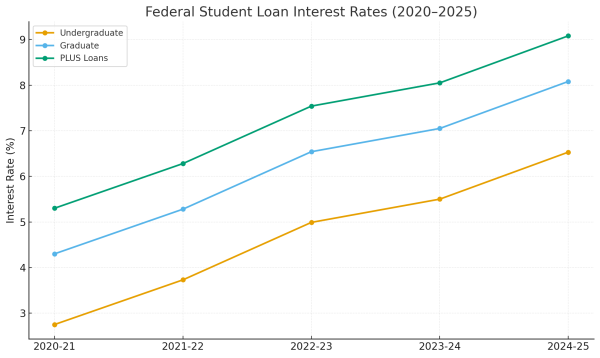

An additional major change was made to federal student aid regarding loan borrowing limits. Beginning July 1, 2026, borrowing limits will be lowered for graduate students.

The current PLUS Loan allows students to borrow up to the cost of their graduate program, but it is being shut down this time next year.

“After that, grad students’ borrowing will be capped at $20,500 a year with a lifetime graduate school loan limit of $100,000, a big drop from the previous cap of $138,500,” according to NPR.

Lilia Anderson, a sophomore finance major expressed thatshe can see how hard this change may be for some people.

“The no interest and the loan forgiveness have helped so many people be able to get through school,” Anderson said. “And for people who need grad school for their career, they had the opportunity to get a loan large enough to help them, but not anymore.”

There are other changes to student aid that are being put in place to help with the end of the SAVE plan.

The repayment options for borrowers are changing dramatically with an option for a standard plan or a Repayment Assistant Plan (RAP).

While RAP is not as generous as SAVE, monthly payments may be lower than with a standard plan.

“As collections begin, the Federal Reserve Bank of New York estimates that more than nine million student loan borrowers will face significant drops in credit score once delinquencies appear on credit reports in the first half of 2025 with some borrowers seeing a reduction in credit scores by more than 150 points associated with new student loan delinquency,” the Economy Policy Institute said.

To find out if these changes impact you, contact the GCSU Financial Aid Office for any questions you may have. 478-445-5149